The Rush to Go Nuclear – and Secure Uranium

The Rush to Go Nuclear – and Secure Uranium

“We won’t fix the looming [uranium] supply deficit without building new uranium mines, something we haven’t done in 20 years… There are several promising uranium deposits that were discovered up to 10 years ago that we are hopeful will be built in this cycle… The industry doesn’t have a choice if it is to ensure diversified sources of supply.” - John Ciampaglia, CEO, Sprott Asset Management

At the 2023 COP28 a declaration to triple nuclear energy capacity by 2050 was formed and has now been joined by 31 nations including the US, Canada, and the United Kingdom. Soon after, 14 major financial institutions including Morgan Stanley and Goldman Sachs joined the declaration, vowing to support the effort to increase global nuclear energy capacity to meet climate goals set forth by the Paris Agreement.

Big tech’s recent ground-breaking deals to power AI data centers with nuclear energy and invest in building out new small nuclear modular reactors in the US also highlight the West’s urgent need to secure stable, carbon-free electricity as energy demand surges.

The New York Times, October 2024

As governments have accepted that renewables alone will not be enough to power rapidly rising energy demands while meeting the goals of the Paris Agreement, the world has committed to nuclear power.

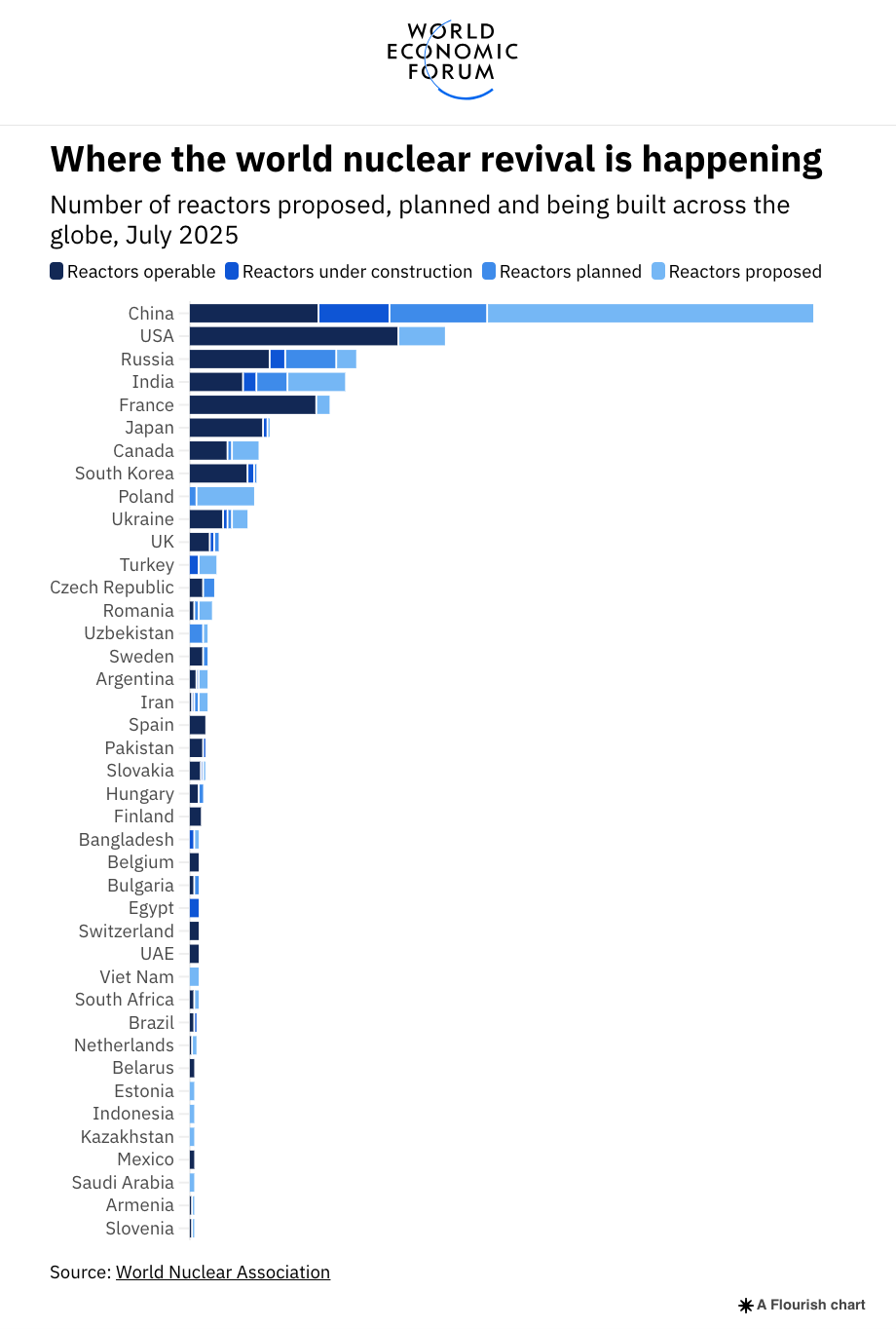

Small modular reactor development is happening fast, placing significant pressure on already strained uranium supplies. According to the World Nuclear Association, globally there are currently 437 operable reactors, 61 under construction, 113 planned, and 328 reactors proposed, meaning the number of global nuclear reactors is set to more than double. The world will need more uranium than ever before to build all these new reactors – and it will need to be secured quickly.

Uranium Supply – Challenges Ahead

Uranium Supply – Challenges Ahead

Concurrently, we’re coming out of what analysts call a lost decade for uranium mining. The price of uranium dropped significantly between 2007 and 2016 and coincided with a prolonged period of underinvestment in the sector following the Fukushima nuclear accident in 2011. Many uranium mines were placed on care and maintenance, and uranium exploration ground to a halt.

Suddenly, uranium demand is booming, and the sector is unprepared. In 2023 long-term uranium contract prices reached 16-year highs due to supply uncertainty and increased demand from utilities expanding capacity for AI data centers. Contracts signed by utilities for uranium topped 160 million pounds in 2023, making it the highest annual volume in over a decade.

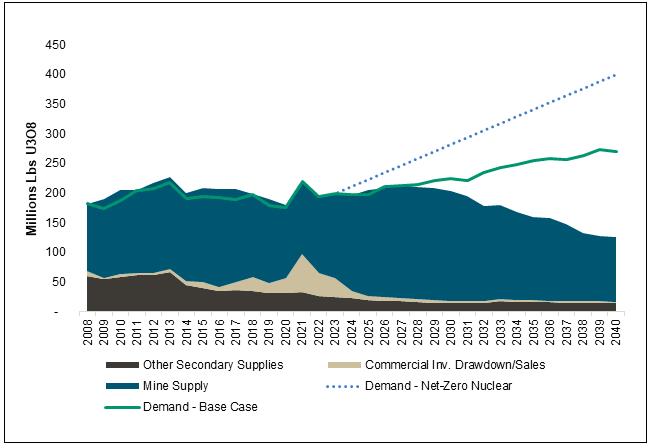

Uranium demand in 2023 was just under 200 million pounds compared to the production of about 145 million pounds, implying a market deficit of ~50-60m pounds. Demand for uranium is expected to increase nearly 30 percent by 2030, and double by 2040. See below.

Source: UxC LLC. and Cameco Corp. Data as of Q4 2023

Source: UxC LLC. and Cameco Corp. Data as of Q4 2023

Canada Could be the Key to Clean Energy Independence

Canada Could be the Key to Clean Energy Independence

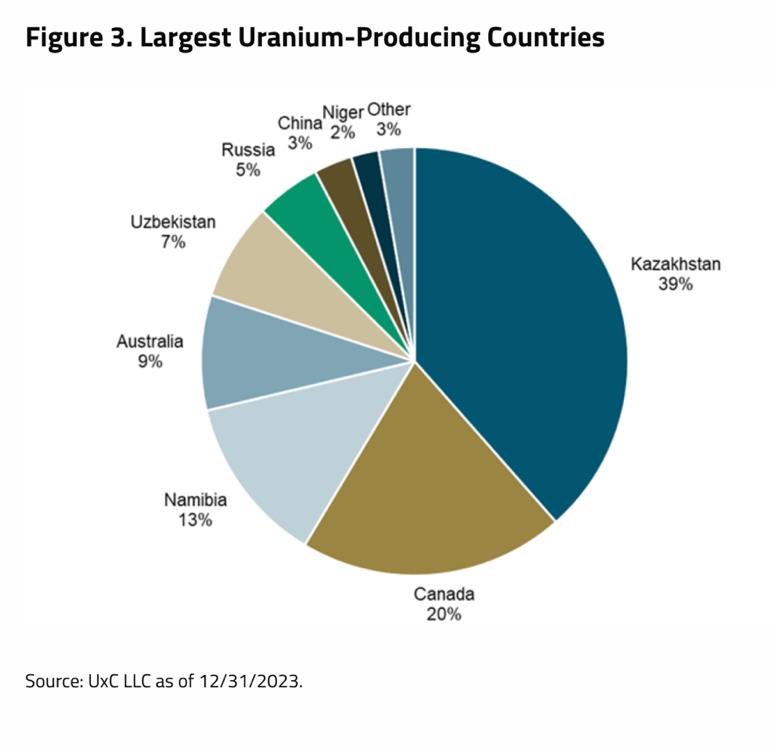

Canada, as the world’s second largest source of uranium, will likely play a large part in this shift back to nuclear. As the West races to secure energy independence following the Russia-Ukraine war, Canadian uranium could prove to be in very high demand.

In Kazakhstan, the world’s largest supplier of uranium, Russia exerts heavy influence over mining activities. Despite Kazakhstan’s efforts to distance itself from Russia, the Kremlin continues to hold stakes in Kazakh mines, which contribute over 40% of the world’s uranium production.

In Namibia, China controls most of the uranium reserves through its state-owned companies, CNNC, CNUC and CGN-URC. Russia and China have also strategically positioned themselves in other countries with under-exploited uranium resources, such as Tanzania, Botswana, and Niger.

Existing Uranium Supply Shortfalls to Persist:

Existing Uranium Supply Shortfalls to Persist:

Adding to future supply uncertainty, existing mines are also experiencing production hurdles. Kazakhstan’s Kazatomprom, which produces about 40% of the world’s uranium, fell short of production targets in 2024 and revised its 2025 production target downward by 17%, which would mean a shortfall of 14 million pounds, or 9% of the world’s mine supply of uranium.

Cameco, the largest uranium mining company by market cap, also had to lower its production forecast in 2023 at its Canada-based Cigar Lake Mine and McArthur River/Key Lake operations, a nearly 3-million-pound shortfall.

Clockwise from left to right: The Washington Post, May 24, 2022; The White House, The United States Government’s Roadmap to triple nuclear capacity by 2050, November 2024;

With global uranium mine production well short of the world’s uranium reactor requirements, rising geopolitical tensions between Russia, China and US, and the supply deficit forecasted to worsen over the next decade, getting new mines into development will be critical.

To meet projected uranium demand over the next decade, idled mines will need to be restarted, planned mines under development will need to come online, and new projects will need to be developed. Significant exploration and timely investments will also be essential to convert uranium resources into refined uranium and triple the world’s nuclear energy capacity by 2050.